NFTs and Blockchain: What You Should Know About the Digital Collectibles Craze

In March 2021, a digital image by a graphic artist known as Beeple was sold in the form of a nonfungible token, or NFT, for $69.3 million, making him the third-most-valuable living artist. This was the first sale in history by a major auction house of a purely digital work of art that doesn’t exist in physical form.1

A nonfungible token is a unique digital asset authenticated by blockchain, the underlying record-keeping technology relied upon to certify its originality and ownership. NFTs first appeared in 2018, but the market took off in 2020 and early 2021 when a flurry of digital collectibles — including images, videos, music, trading cards, sports highlights, virtual real estate in online gaming worlds, tweets, gifs, and even viral memes — were minted as NFTs and traded as assets.

A blockchain is a digital ledger shared among a network of computers. The technology was initially invented for the peer-to-peer exchange of the virtual currency Bitcoin. NFTs are credited with helping artists, musicians, and digital media companies to monetize and control the use of their creations. However, businesses in other industries are also working on some potentially game-changing blockchain applications.

Unlocking Potential

A blockchain can be public (open) or private (closed). All network participants have simultaneous access to a single body of strongly encrypted data. When new information is added, it is time-stamped and linked to the prior record, like a series of blocks in a digital chain. This establishes an exact and transparent order of events. A blockchain can also be coded to execute or enforce smart contracts automatically when certain conditions are met. Because no third-party intermediary (or central authority) is needed, transactions can be completed instantaneously and at a lower cost.

Any system or business that relies on a database could be a candidate for blockchain-based innovation. Beyond cryptocurrency and NFTs, some possible applications include real-time securities trading, public real estate registries, identity verification, fraud prevention, electronic medical records, supply-chain tracking, and online voting, among others.

Opportunities and Costs

Widespread adoption could be years away, but blockchain may eventually be a transformative and/or disruptive force that creates a new set of winners and losers in the marketplace. There may also be some societal costs, such as high energy consumption from running powerful computers, and the technology’s potential to displace human workers.

All investing involves risk, including the possible loss of principal, but new technology ventures are especially risky. Some of the blockchain projects in development may turn out to be viable and profitable, but many others could fail. It is important to be skeptical when evaluating a claim made by a company about its entry into this arena. Steer clear of unsolicited and Internet-based investment offers — and never wire money to pay for an offer or service.

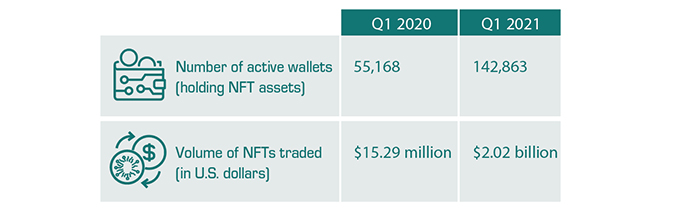

A Big Year for the NFT Market

Source: nonfungible.com, 2021

Avid fans and collectors may be happy to support artists whose work they admire by purchasing NFTs, but they should be aware that these are highly speculative investments. Just like some physical collectibles, NFTs may have little intrinsic value and can be sold only if there are willing buyers. Prices can be extremely volatile, and there is a high risk of loss as pop-culture trends shift. Many NFTs could eventually become worthless.

Profits on the sale of NFTs that have appreciated are typically subject to capital gains tax, and some NFTs are defined as collectibles under the tax code. This means that investors with taxable incomes over $445,850 for single filers or $501,600 for married joint filers (in 2021) who sell collectibles held longer than one year would be taxed at a maximum rate of 28% instead of the regular long-term capital gains rate of 20%, and they may also be subject to the 3.8% net investment income tax. Short-term capital gains on collectibles held less than one year are taxed as ordinary income, as they are with other investments.