The Transforming Landscape of Higher Ed: Balancing Cost, Choices, and Challenges

In the ever-evolving realm of higher education, a recent 2023 survey illuminates a significant shift in public sentiment over the past decade concerning the perceived value of a college degree. A decade ago, 42% of Americans believed that the benefits of a college education outweighed its costs. However, the landscape has changed dramatically, with 56% now expressing doubts due to substantial student debt and concerns about acquiring job-specific skills. Simultaneously, college enrollment has experienced a decline of approximately 15%, reflecting the changing attitudes towards pursuing higher education.

At the heart of this transformation lies the hefty price tag associated with attending college. The academic year 2022–2023 saw the cost of college soar: around $23,250 for a year at a public college in the same state, $40,550 for out-of-state colleges, and a staggering $53,430 for private institutions. Exceptionally renowned private colleges can even exceed $80,000 annually. This financial burden has led many to reconsider whether the investment is worth the potential benefits.

The Complex Landscape: A Closer Look

The landscape underwent a seismic shift during the pandemic, as colleges shifted to online learning, leaving students with high tuition bills and an absence of traditional campus experiences. As a result, the percentage of high school graduates entering college dropped to 62%, down from 66.2% before the pandemic. The allure of the job market, coupled with higher earnings for those without college degrees, has made bypassing higher education for immediate employment increasingly attractive. Meanwhile, alternative avenues such as apprenticeships and certificate programs have gained prominence as viable routes to career success.

The metamorphosis extends to how financial aid is structured. The Free Application for Federal Student Aid (FAFSA) has been revamped, with a simplified form boasting fewer questions and mandatory direct transfer of financial information from the IRS. These adjustments aim to enhance accessibility, especially for low-income students. However, some changes could adversely impact aid availability, particularly for middle- and high-income students. Notably, grandparents' and relatives' contributions will no longer affect aid eligibility under the new FAFSA, alleviating financial concerns.

The Ongoing Conundrum of Student Loans

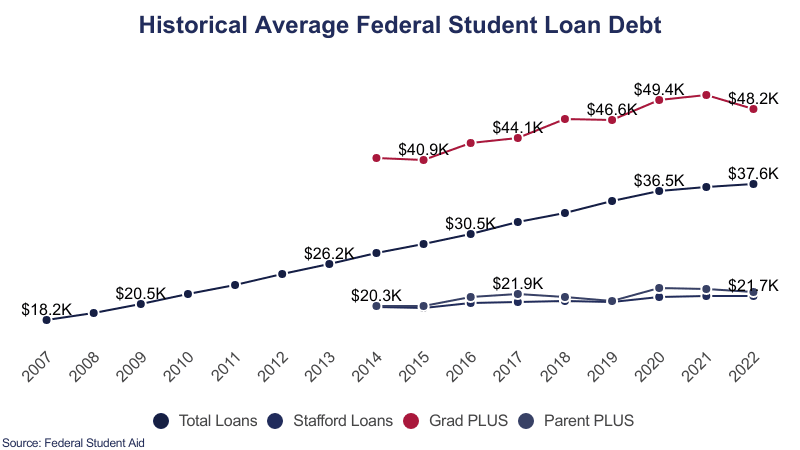

The rising cost of tuition and expenses often compels students to rely on federal and sometimes private loans. The class of 2021 graduated with an average student debt of $29,100. Interest rates on federal student loans have escalated based on the 10-year U.S. Treasury note, reaching their highest levels in a decade for the 2023–2024 academic year. Despite the hopes stirred by an executive order in 2022, offering loan forgiveness for specific income brackets, the subsequent overturning of this order by the U.S. Supreme Court in 2023 reinstated the obligation for borrowers.

The rising cost of tuition and expenses often compels students to rely on federal and sometimes private loans. The class of 2021 graduated with an average student debt of $29,100. Interest rates on federal student loans have escalated based on the 10-year U.S. Treasury note, reaching their highest levels in a decade for the 2023–2024 academic year. Despite the hopes stirred by an executive order in 2022, offering loan forgiveness for specific income brackets, the subsequent overturning of this order by the U.S. Supreme Court in 2023 reinstated the obligation for borrowers.

Critical Evaluation of the College Investment

The decision to pursue higher education hinges on a multitude of factors, primarily the anticipation of lucrative career opportunities and access to professions requiring degrees. A comprehensive analysis from Georgetown University underscores the substantial variation in lifetime earnings among college graduates. The financial discrepancy between graduates with diverse majors is staggering, with STEM disciplines, business, and health-related fields leading to the highest return on investment. Careful consideration of earning potential within chosen fields becomes paramount when evaluating the value of a college education.

Strategies for Fiscal Responsibility

Mitigating excessive borrowing and securing financial stability while pursuing higher education necessitates strategic planning:

-

Opt for colleges with lower costs.

-

Start at a community college and then transfer to a four-year institution.

-

Explore need-based and merit-based financial aid opportunities.

-

Consider options like living at home or working as a resident assistant for free housing.

-

Engage in part-time employment while managing finances prudently.

-

Utilize college credits earned during high school to expedite graduation.

The evolving landscape of higher education presents a myriad of considerations. While college remains a valuable avenue for many, the financial implications, evolving aid structures, and varied career trajectories underscore the importance of informed decision-making to secure a prosperous future.

- The Wall Street Journal, March 31, 2023, and March 29, 2023

- The College Board, 2022

- Harvard University, 2023; Stanford University, 2023

- CNBC, June 17, 2023

- The New York Times, June 30, 2023

- Georgetown University, 2015 (most current data)