The Elephant In The Room .

Let's talk about the big elephant in the room... death. Nobody likes to talk about dying, let alone their loved ones dying, but in all reality it is one of the more important topics you can discuss. Why you might ask? Whenever somebody dies, they leave behind what is referred to as an "estate". An estate is defined as the net worth of a person at any point in time, alive or dead. It is the sum of a person's assets – legal rights, interests and entitlements to property of any kind – less all liabilities.

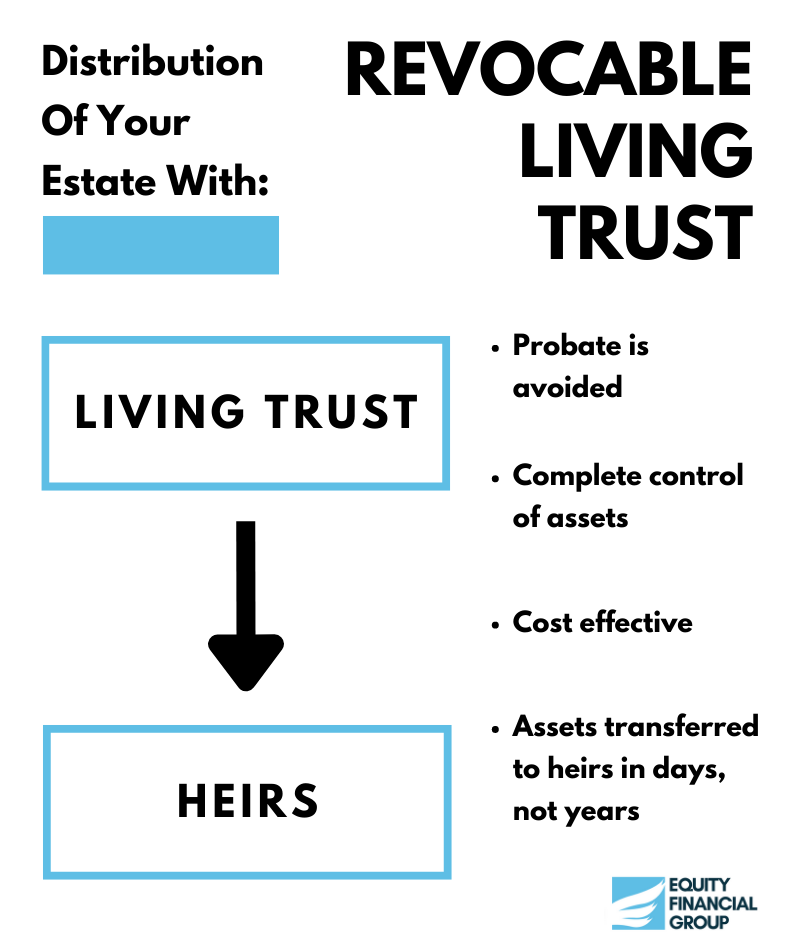

.png) The process of settling and distributing the estate is referred to as estate administration. It is this very process and how it has been planned-for and setup, that will determine important factors such as how the estate is to be distributed, who manages the estate, how long the settlement process will take, how much the estate settlement will cost, and if the settlement will be made available to the public.

The process of settling and distributing the estate is referred to as estate administration. It is this very process and how it has been planned-for and setup, that will determine important factors such as how the estate is to be distributed, who manages the estate, how long the settlement process will take, how much the estate settlement will cost, and if the settlement will be made available to the public.

The Two Paths: Probate vs No Probate

There are essentially two paths that an estate can go down when it comes to the administration and settlement process, probate or non-probate. A probated estate is one in which a court determines how to distribute your estate/property after you die. A non-probated estate is privately settled and distributed via the wishes of the deceased, keeping the estate out of the courts and public eye.

THE PROBATE PROCESS

As discussed earlier, when an estate is probated, all assets and property within the estate will be left in the hands of the courts until the estate is settled. You might be wondering what assets are required to go through probate - probate assets are assets wholly owned by the decedent. The following are examples:

-

Real estate owned entirely in the decedent's name or as a tenant in common

-

Jewelry, furniture, and vehicles are examples of personal property.

-

Bank accounts in the exclusive name of the deceased

-

A stake in a corporation, partnership, or limited liability company

-

Any life insurance policy or brokerage account in which the dead or the estate is named as the beneficiary

Your family's assets will be frozen during the first round of probate procedures. This means that none of these assets are available for withdrawal, transfer, or sale. If your family needs money to pay living expenses, they must ask the court for a living allowance. The court may deny that allowance, denying your family access to your assets for a period of time after you die.

How Long Does Probate Take?

The length of time it takes to complete probate can vary greatly depending on the circumstances of the estate and the efficiency of the probate court. In general, the process can take anywhere from several months to several years, with the average sitting somewhere between 12 - 24 months.

How Much Will Probate Cost?

From a monetary standpoint, It is not uncommon for the cost of probate to range from a few thousand dollars to tens of thousands of dollars, depending on the circumstances. Some estimates suggest probate can easily cost anywhere from 3% - 8% of the gross estate.

In any case, probate is not cheap and will without a doubt cost the estate a significant amount of money, but what about the other costs? As we discussed, probate will also consume a considerable amount of time, and not just for the courts. For those appointed by court to help administer the estate, it can require working 12 hours a week, until the estate is settled. Which means if things went smooth and the estate was settled in one year, an individual could be putting in 624 hours of work.

Does A Will Keep The Estate Out Of Probate?

A will is a legal document that says what you want to happen to your property when you die. It also lets you name guardians for any minor children and an executor who will be in charge of carrying out your wishes after you die. You can leave property to your heirs through a will, but it might not be the best way to do it, as simply having a last will does not avoid probate.

When an individual dies with all assets wholly owned/titled in his or her name, probate cannot be avoided. But if before the passing of an individual, all wholly owned assets are retitled and moved into a revocable living trust - when the individual dies the estate will not be probated.

THE ESTATE PLANNING PROCESS

Our mission is to help hard-working families stop losing money on poor planning. Estates can be lost in part due to bad investments, probate, former spouses, poor spending by beneficiaries, and more. The truth is, what used to work: create a will, leave it in the cabinet for 20 years, doesn't work anymore. After reading the first half of this article, you can see that sometimes inheritance is a gift that can turn out to be a curse. If the thought of leaving your estate and hard earned assets to the pitfalls of probate makes you feel uneasy, there is an avenue available, but it's important to understand that the solution requires action on your part!

Why Is An Estate Plan Important

The purpose of estate planning is to ensure that you leave the kind of legacy you want for your loved ones and other cherished possessions. Your life and your aspirations transcend money – they also embrace your ideals. Your desires may involve utilizing your assets to aid in preserving your family's future, or you might opt to support a cause or organization you’re passionate about.

What Are The Advantages Of An Estate Plan?

A comprehensive estate plan can assist in providing protection before and after your life, and allows you to:

- Safeguard your assets. In the event that you are unable to make decisions or speak for yourself, you can ensure that your wants and needs are honored.

- Avoid Probate. Keep your estate out of the dreaded probate process.

- Make certain that your desires are met. End-of-life care is an essential topic to discuss with your loved ones. You can define your ultimate desires and make particular provisions for your remains in an estate plan.

- Keep your mind at ease. Without an estate plan, the door opens up for an individual's assets and possessions to enter probate. Estate planning can assist in reducing your family's financial burden following your death.

- Keeping matters private. You can avoid probate if you create an estate plan ahead of time. As a result, the details of your estate settlement would not be made available to the public.

- Reduce the number of tax transfers. If you intend to leave your fortune to loved ones after you die, estate planning maybe able to help you lessen the impact of taxes on your assets.

- Help a cause that is important to you. You can leave all or part of your estate to a charity of your choice – and make an impact that will last beyond your lifetime.

- Can be amended anytime, while both spouses are alive.

I Need An Estate Plan, How Can I Get One?

If you believe you can benefit from the advantages of an estate plan with a revocable living trust, we can help you build the most effective and efficient plan for your estate. It's important to remember:

- As a trustee you can buy, sell, encumber, trade, or gift any asset in the trust.

- You can change or revoke the trust at anytime.

- You, and only you, will always have full control of your trust and estate while you are living.

None of us like to think about our own mortality, or even the chance of becoming physically or mentally incapacitated. Which is exactly why so many families are caught off gaurd and unprepared when incapacity or death strike.

Estate Planning: Related Topics

.png)