The Institute for Supply Management (ISM) serves as a crucial barometer for the health of the U.S. economy, providing insights that are invaluable for economists, investors, and businesses alike. Two of its primary tools are the Manufacturing Purchasing Managers Index (PMI) and the Services PMI, each offering a unique window into different sectors of the economy.

Manufacturing PMI: A Sign of Economic Health

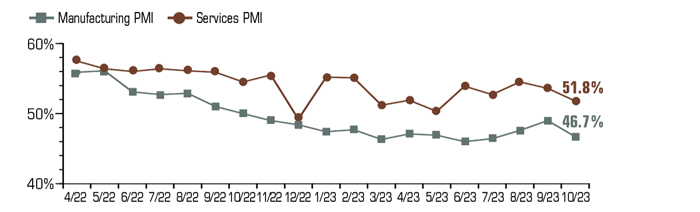

The Manufacturing PMI is a vital indicator, particularly for gauging the condition of U.S. factories. It reflects changes in production levels, new orders, employment, supplier deliveries, and inventories. A reading below 50% suggests a contraction in manufacturing activity. Notably, in October 2023, this index fell to 46.7%, marking a full year of contraction. This was a clear signal of the pressures facing manufacturers, from inflation to rising borrowing costs impacting customer demand.

Services PMI: The Larger Picture

The Services PMI, on the other hand, offers a broader perspective on the service sector, encompassing industries like Real Estate, Health Care, and Finance. In contrast to the Manufacturing PMI, this index indicated expansion in October 2023, with a reading of 51.8%. This shows how growth in the service sector can sometimes counterbalance manufacturing weaknesses, a phenomenon observed in previous years.

Divergent Paths: Manufacturing and Services

Throughout 2023, the Manufacturing PMI generally lagged behind the Services PMI. This divergence suggested mixed signals for the U.S. economy, with the manufacturing sector struggling while services showed resilience. Such disparities are critical for businesses and investors, as they can guide strategic decisions and investments.

The Reshoring Movement

An intriguing aspect of the current economic landscape is the trend of reshoring. The U.S. has seen a significant shift from manufacturing-led GDP in the late 1970s (21% of GDP) to a more service-oriented economy today (11% of GDP). The pandemic highlighted the vulnerabilities in global supply chains, pushing many companies to bring production back to the U.S. The year 2022 was set to see a record number of jobs reshored, a stark contrast to the numbers a decade ago.

Takeaway

Understanding these indexes is crucial for anyone interested in the economy. They are leading indicators, providing early signals of future economic trends. For students and professionals in economics, finance, and business, these indexes offer real-world examples of how macroeconomic forces interact and shape the business landscape.

A Word of Caution: While these indexes are insightful, it's important to remember that all investing involves risk. Economic conditions are ever-changing, and projections based on current data may not always materialize. Therefore, staying informed and adaptable is key to navigating the complex world of economic indicators and market trends.