Starting Early Makes A Difference (a VERY big difference)!

Imagine two peers, Harper and Edward, embarking on their retirement saving journeys at different stages in their lives, both contributing to their Individual Retirement Accounts (IRAs) over the course of 42 years, yet with strikingly different outcomes. (In this example both investors enjoy an annual return of 8%).

At the young age of 25, Harper starts making an annual contribution of $7,000 to her IRA, continuing this tradition for a decade. By age 35, after her final contribution, Harper's investment totals $70,000. On the other hand, Edward delays his retirement planning, beginning his annual $7,000 contributions at 35 and maintaining this investment for 32 years, culminating in a total investment of $224,000.

2024-Equity-Financial-Group-Get Started Early - IRA

Despite Harper's significantly lower investment—$154,000 less than Edward's—and her shorter investment timeline of just 10 years compared to Edward's 35 years, the power of early investing becomes evident. Harper's IRA flourishes to a gain of $1,215,000, overshadowing Edward's gain of $715,000.

This example showcases the profound impact of starting early and leveraging the magic of compound interest, illustrating how time in the market can be far more influential than the amount invested. Let this be a reminder of the incredible advantage early and consistent investing has on long-term financial growth.

Start early, stay disciplined, and watch your investments soar!

Start Understanding Your Investor Personality

Click here or the image above to get started

Get started today, and understand what type of investor personality you have. Whether you already have an IRA, 401k, an account with another advisor, or are ready to begin your investment journey - this is a great tool to better understand yourself as an investor.

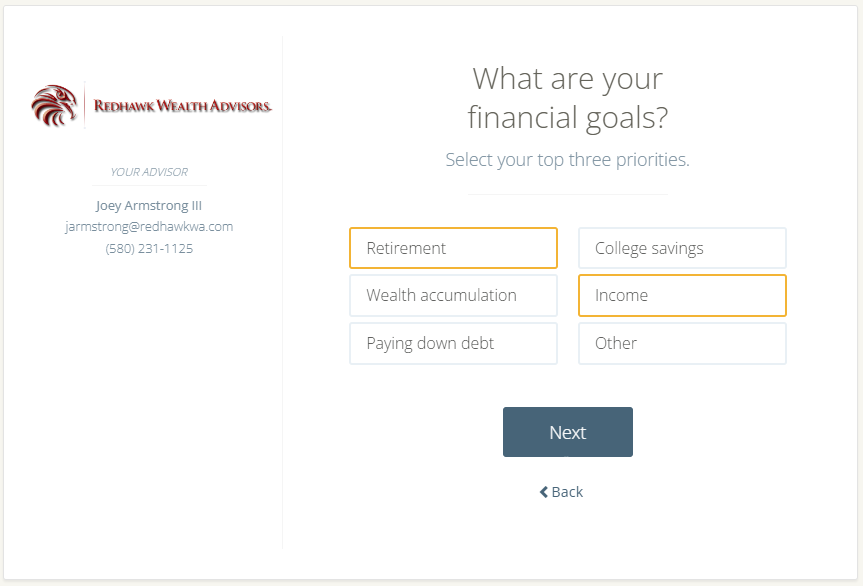

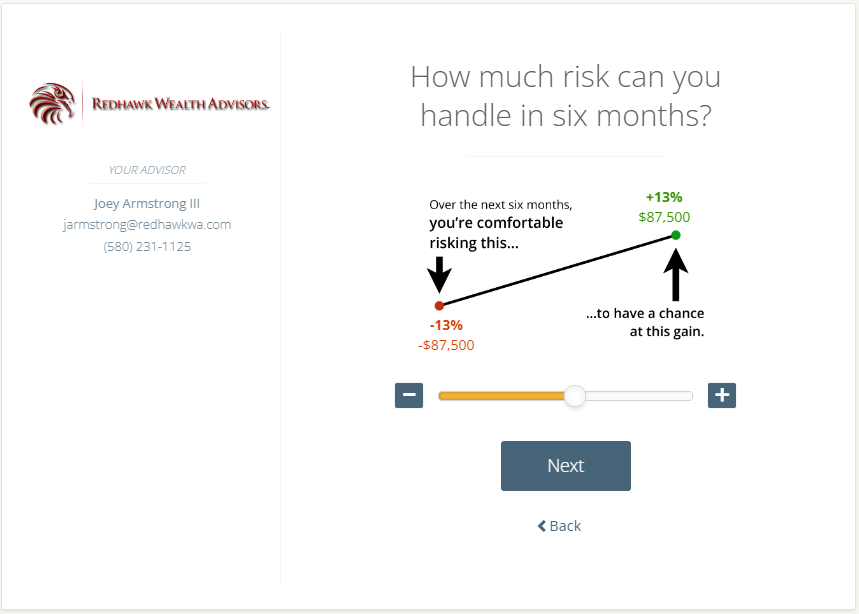

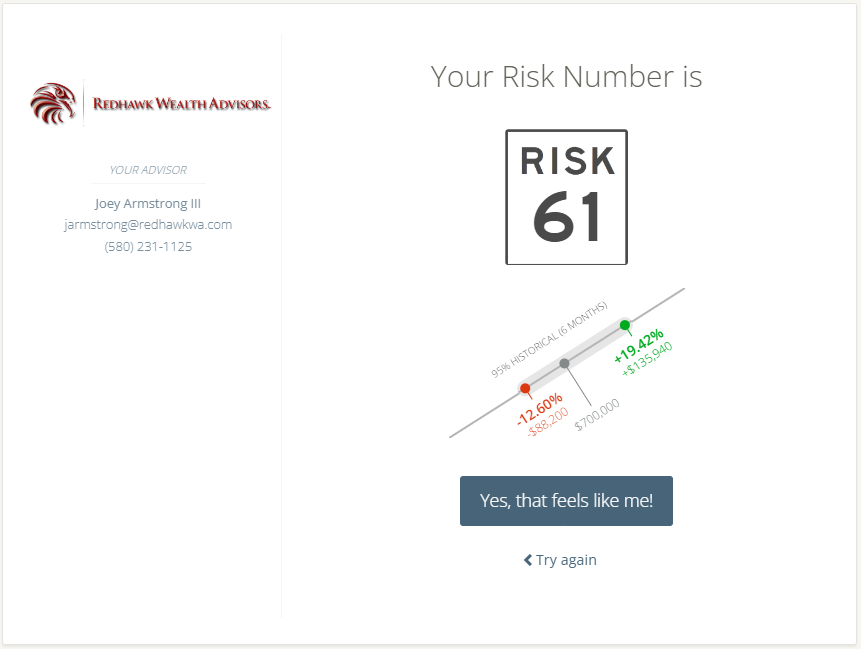

Cick the image above or below to use our free portfolio risk tool, and find your Risk Number. Below are some examples of what you will see when you begin your analysis.

There is a shift going on from measuring the emotional and subjective response to a quantitative and objective approach that understands when an investor prefers risk and when they prefer certainty, based on the dollar amounts relevant to their financial capacity. We use an application called Riskalyze to help investors see just how much risk they are taking or need to take.

It provides an investor with a clear picture of where they are in the risk spectrum and where they need to be. Simply put, it does a better job at capturing an investor's appetite and capacity for risk.

Click here to begin your Risk Analysis!

More From Equity Financial Group

What's An Investor Personality?