Demystifying Variable Annuities: A Comprehensive Guide to Risks and Hidden Fees

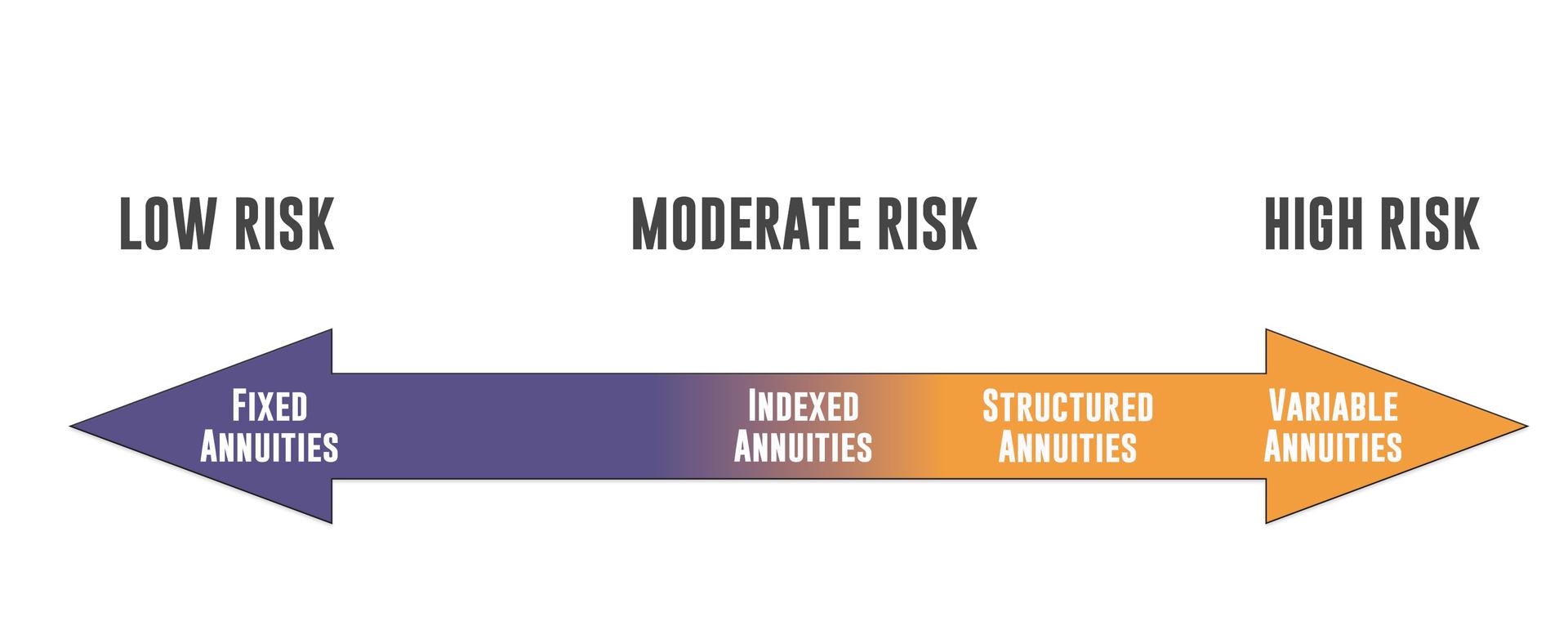

Variable annuities have garnered popularity as a potential solution for individuals aiming to secure a consistent income stream throughout their retirement years. While they offer unique advantages, their inherent complexity and myriad of associated fees pose significant risks that should not be overlooked. In this comprehensive guide, we aim to unpack the intricacies of variable annuities, shed light on potential dangers, and expose instances where hidden fees have taken a toll on unwary investors.

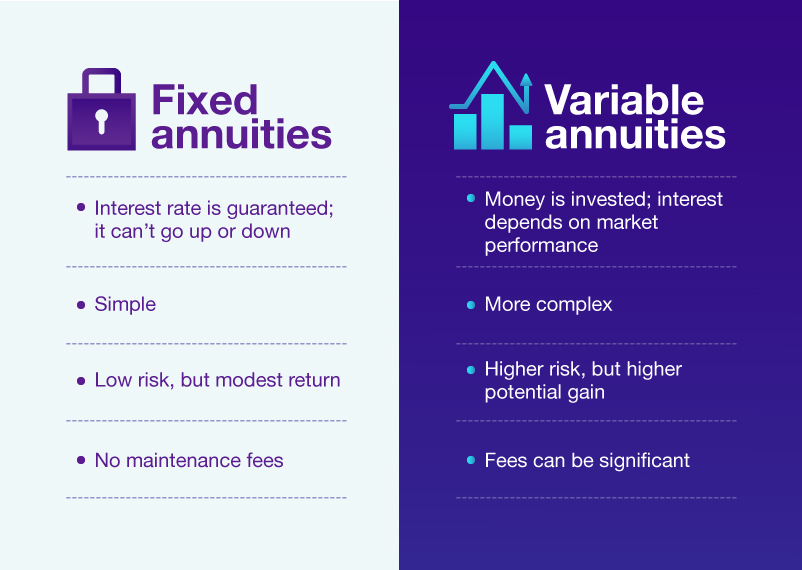

Decoding Variable Annuities: A variable annuity stands as a contractual agreement between an individual and an insurance company. The investor commits to making either a lump-sum payment or a series of payments, in exchange for regular disbursements set to commence at a future date. The ultimate value of the annuity and the amount of the payouts are contingent upon the performance of the selected investment options.

Identifying the Risks and Hidden Dangers

1.) Market Vulnerability: The performance of variable annuities is inextricably linked to market conditions. Poor investment performance can lead to a diminution in the value of the annuity, adversely impacting the amount of future payouts.

- Imagine you’ve invested $100,000 in a variable annuity, and you’ve chosen to allocate your money in a stock market fund through the annuity.

your money in a stock market fund through the annuity.

Good Market Conditions: If the stock market performs well, and your investment grows by 10%, your annuity value would increase to $110,000. This means that your future payouts would be calculated based on this higher amount, potentially leading to larger income streams during retirement.

Poor Market Conditions: Now, let’s say the stock market takes a downturn, and your investment loses 10% of its value. Your annuity would now be worth only $90,000. Since the value of your annuity has decreased, the amount of money you’ll receive in future payouts would also be less.

Considering Fees and Costs: Now, let’s not forget about the various fees associated with variable annuities. Imagine in this scenario that the combined fees for mortality and expense risk charges, administrative fees, fund management fees, and any additional riders amount to 3% annually.

So, if your investment in the annuity has decreased in value to $90,000 due to poor market performance, after accounting for the 3% in fees, you would be left with an end value of about $87,300 for that year.

So, the client would need an approximate gain of 14.53% on their investment just to get back to the original investment level of $100,000. This calculation does not take into account any potential future fees that could be applied as the investment grows.

This example demonstrates how market vulnerability can directly impact the value of your variable annuity and the income it can generate. It underscores the importance of understanding the risks and being prepared for the ups and downs of the market when considering a variable annuity as part of your retirement planning strategy.

2.) Demand for Long-Term Commitment: These financial products are typically accompanied by surrender charges, imposing hefty fees on investors for withdrawals made within a specified period. Such surrender periods can span several years, necessitating a prolonged commitment or the risk of substantial financial repercussions.

- Longer-term investments can offer stability and often yield higher returns as a reward for the investor’s patience and commitment. These products are structured to encourage a long-term perspective, ensuring that funds are available when they are most needed, such as during retirement. Surrender charges, in this context, serve as a mechanism to stabilize the funds within the investment, allowing the financial institution to make long-term investment decisions that can potentially benefit all parties involved.

- It’s imperative for investors to understand that longer-term commitments and surrender charges are not inherently detrimental features of an investment product. Rather, they should be evaluated in the context of the individual’s financial goals, investment horizon, and tolerance for risk. A variable annuity, like any other long-term investment product, can be a valuable component of a diversified portfolio if chosen judiciously and with a comprehensive understanding of its terms and conditions.

Navigating Long-Term Commitments: Variable annuities often necessitate a commitment over an extended period, accompanied by surrender charges for early withdrawals. These charges tend to be steep in the initial years and gradually decrease over time. It’s crucial to contextualize this aspect by recognizing that several reputable investment products, including Certificates of Deposit (CDs), Fixed Indexed Annuities, and Multi-Year Guaranteed Annuities (MYGAs), also involve longer-term commitments and potential surrender charges.

3. ) Bewildering Fee Structures: Variable annuities are infamous for their convoluted fee arrangements, potentially subjecting investors to an array of charges, such as: a. Mortality and Expense Risk Charges, averaging around 1.25% of the account’s annual value. b. Administrative Fees, covering record-keeping and other clerical tasks. c. Surrender Charges, with penalties for early withdrawal reaching up to 10% in initial years. d. Fund Management Fees, associated with the investments within the annuity. e. Riders, or optional features, that can introduce additional costs.

3. ) Bewildering Fee Structures: Variable annuities are infamous for their convoluted fee arrangements, potentially subjecting investors to an array of charges, such as: a. Mortality and Expense Risk Charges, averaging around 1.25% of the account’s annual value. b. Administrative Fees, covering record-keeping and other clerical tasks. c. Surrender Charges, with penalties for early withdrawal reaching up to 10% in initial years. d. Fund Management Fees, associated with the investments within the annuity. e. Riders, or optional features, that can introduce additional costs.

4.) Capped Growth Potential: Some variable annuities incorporate caps or participation rates, potentially limiting the investor’s return on investments, even in a flourishing market.

Exposing Instances of Excessive Fees: The financial landscape is riddled with accounts of investors burdened by exorbitant fees tied to variable annuities. Prominent amongst these are cases involving major financial institutions, met with multimillion-dollar fines for their failure to adequately disclose the costs and risks tied to variable annuities. These oversights resulted in significant financial losses for the investors involved.

Drawing Conclusions

Variable annuities, with their tax-deferred growth potential and prospects for a guaranteed income in retirement, offer enticing benefits. Nonetheless, the risks associated and their intricate fee structures render them a costly investment avenue. It is imperative for investors to engage in thorough research, seek counsel from impartial financial professionals, and meticulously scrutinize the fine print prior to making a commitment to a variable annuity. A well-rounded understanding of the associated risks, fees, and potential for incurring high costs is vital, empowering investors to make well-informed decisions and safeguard themselves from the lurking dangers of variable annuities.

Click the image above to get in touch with us for your free, no-obligation Second Opinion.

Disclaimer: This article is provided for informational purposes only and is not intended to serve as financial advice. The content herein reflects the author’s understanding and interpretation of variable annuities and associated risks as of the date of publication. Market conditions, legal regulations, and financial products are subject to change; hence, it is imperative for readers to conduct their own research and consult with a licensed financial advisor before making any investment decisions. The author and publisher of this article shall not be held liable for any financial losses or damages resulting from the use of the information provided.