Yielding Insights: Understanding Risks in an Evolving Bond Market

The landscape of bond investing has become increasingly attractive as yields have risen, presenting an opportunity for investors with varying risk tolerances. Bonds offer a blend of stability and income, making them particularly appealing to retirees and those close to retirement who are looking to realign their portfolios.

Although traditionally seen as lower risk compared to stocks, bonds are not free from danger. Investors must be aware of the different types of risk when considering bonds. The coupon rate represents the interest on a bond's face value, while the yield reflects the return based on the purchase price; thus, a bond bought below face value will have a higher yield than the coupon rate, and vice versa.

Let's delve into the specific risks in bond investing:

Interest Rate Risk: As interest rates increase, existing bonds with lower coupon rates lose their appeal because newly issued bonds offer higher rates. This can lead to a drop in market value for existing bonds, though it does not affect bonds held to maturity.

Duration Risk: The price sensitivity of a bond to interest rate changes is defined by its duration, with longer-term bonds being more susceptible. A rise in interest rates by 1% could lead to a corresponding decrease in a bond's market value by an amount proportional to its duration.

Opportunity Risk: Longer-term bonds carry the risk of locking investors out from potentially more lucrative investments that may emerge, as well as the risk that other factors may negatively impact the investment.

Inflation Risk: The possibility that a bond’s yield won’t keep up with inflation is a significant concern, especially in high-inflation environments. As inflation stabilizes, bonds with higher current yields could potentially provide returns that surpass inflation.

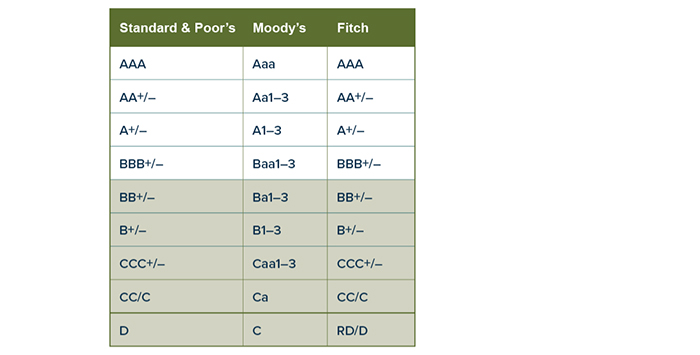

Credit Ratings and Credit Risk: Credit ratings, assigned by agencies like Standard & Poor’s, Moody’s, and Fitch, indicate the creditworthiness of bond issuers, ranging from high-grade investment bonds to lower-grade, higher-yield "junk" bonds. Bonds can also be insured, which adds a layer of protection against defaults.

Call Risk: This is the risk of a bond being redeemed by the issuer when interest rates decline, which can be mitigated by investing in non-callable bonds.

Market Variability: Bonds' principal value can fluctuate with market conditions, with early redemption potentially affecting the original investment value. Higher yields are also associated with a higher degree of risk.

To summarize, the role of bonds in an investment portfolio has evolved, offering benefits and risks that investors must carefully evaluate. Interest rate movements, credit ratings, investment timeframes, and market conditions all play critical roles in bond investment decisions. Investors should conduct thorough research and understand their financial objectives when considering bond investments in the current market.