Life Insurance Essentials: Smart Strategies for Choosing Life

Life insurance stands as a critical component in financial planning, offering a safety net for your loved ones in the event of your untimely passing. Given the potential earnings over a lifetime, securing this asset is essential for the financial security of your family. Understanding the various types of life insurance is key to making an informed decision that aligns with your needs and goals.

Understanding the Basics of Life Insurance

Life insurance is designed to provide financial support to your dependents by replacing lost income following your death. Selecting the right policy requires understanding the different types available and how they align with your financial planning.

Term Life Insurance: Protection for a Specific Period

Term life insurance is often referred to as "pure" life insurance. It offers coverage for a predetermined period - ranging from one to 30 years or more. If you pass away during this term, the designated beneficiary receives the death benefit. However, if you outlive the term, the coverage ceases, often without any return of premium. Key points include:

- Renewability: Some policies allow renewal at a higher premium, often without a health examination.

- Premiums: These usually increase with age due to the higher risk of death.

- Conversion Feature: Many term policies offer the option to convert to permanent insurance without a health questionnaire.

Whole Life Insurance: Lifelong Coverage and Cash Value

Whole life insurance, a form of permanent life insurance, offers lifelong coverage with the additional benefit of a cash value account. Premium payments exceed the current cost of insurance, with the excess being credited to this account. Notable aspects are:

- Cash Value Growth: Accumulates tax-deferred and can be accessed through loans or policy surrender.

- Level Premiums: Ensures consistent payments throughout the policy's life.

- Impact of Loans/Surrenders: These can reduce the death benefit and, in the case of a full surrender, terminate coverage.

The Growing Demand for Life Insurance

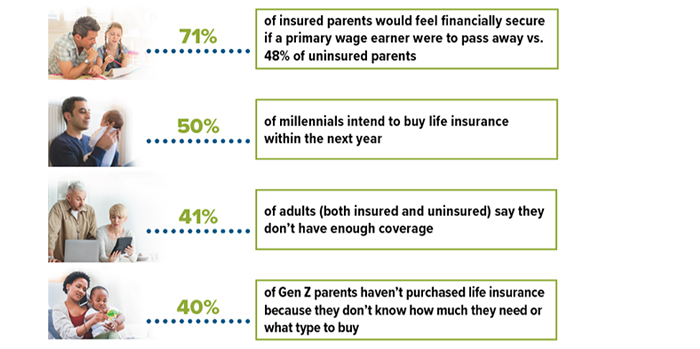

Recent studies, like the 2023 Insurance Barometer Study by Life Happens and LIMRA, highlight a strong interest in life insurance. Approximately 71% of insured parents feel financially secure, compared to 48% of uninsured ones. Millennials and Gen Z show a growing awareness and interest in life insurance, yet many lack sufficient coverage or understanding of their needs.

Universal Life Insurance: Flexibility in Premiums and Benefits

Universal life insurance combines the permanent coverage of whole life with added flexibility. Key features include:

- Adjustable Premiums: Can be increased or decreased within policy limits.

- Impact on Benefits: Changes in premiums affect the cash value and potentially the death benefit.

- Death Benefit Options: Policies may offer a choice between level or increasing death benefits, with the ability to adjust coverage subject to insurability and medical exams.

Key Considerations in Choosing Life Insurance

When selecting life insurance, consider factors like age, health, the type and amount of insurance needed, and the insurer's financial strength. Be aware of associated costs, such as mortality and expense charges, and understand how loans and withdrawals can impact the policy's value and benefits.

Conclusion

Choosing the right life insurance policy is a significant decision requiring careful consideration of your financial situation and future goals. By understanding the different types of life insurance and their respective features, you can make an informed choice that provides peace of mind and financial security for your loved ones.