Setting a Robust Retirement Savings Goal: A Comprehensive Guide

Understanding your retirement target is crucial, yet surprisingly, only about half of the workers or their spouses have attempted to calculate the savings required for a comfortable retirement. This comprehensive guide aims to bridge this gap by providing a detailed approach to setting a retirement savings goal.

Establishing Your Retirement Income Needs

Your post-retirement income needs are unique, yet a general rule of thumb suggests needing 70% to 80% of your pre-retirement income. This guideline assumes major expenses like mortgages are paid off, and daily costs such as transportation and clothing are reduced post-retirement. However, this may be offset by new expenses in retirement, like travel or hobbies.

Critical Consideration of Healthcare Costs

Healthcare costs in retirement are often underestimated. A study indicated that a couple retiring in 2022 might need approximately $318,000 to cover health-related expenses alone, excluding costs like dental or long-term care. These figures highlight the importance of factoring healthcare into your retirement budget, especially considering the likelihood of increasing costs in the future.

Income Sources Estimation

Social Security: Utilize the Social Security Administration's website (ssa.gov/myaccount) to estimate your benefits. Keep in mind that these estimates can vary based on future salary changes and potential policy adjustments.

Pension Plans: If you have a pension, obtain an estimate from your employer. Pensions can form a significant part of retirement income, especially for long-term employees.

Additional Income: Consider other income sources, such as consulting or part-time work. However, be realistic about the potential earnings from these sources. For instance, in 2023, while 73% of workers anticipated working post-retirement, only 30% of retirees actually did so.

Investment and Market Risks

The return on your investments can significantly impact your retirement savings. While higher market returns can grow your nest egg faster, it's safer to calculate using modest return rates. Remember, all investments carry risks, including the potential loss of principal. A balanced approach considering both the potential for higher returns and associated risks is crucial.

Practical Steps to Calculate Your Savings Goal

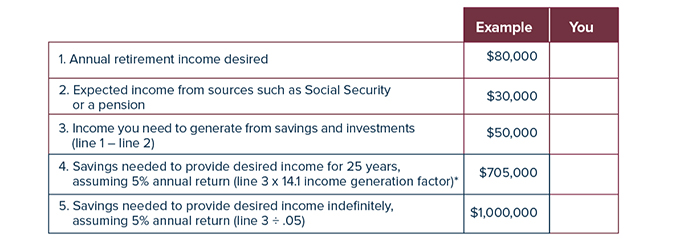

The chart below might provide you with a general idea of what you may need to save, to achieve your desired retirement income.

Employ a factor of 12.5 if planning for a 20-year retirement duration, or 15.4 for a 30-year span; note that these factors are approximations. Be aware that this example is hypothetical and doesn't include considerations for taxes or inflation, serving solely for demonstration purposes. Additionally, investment return rates are subject to fluctuation over time, especially with long-term investments, so actual outcomes may differ.

Determine Desired Annual Retirement Income: For example, if you aim for an $80,000 annual income and expect $30,000 from Social Security or pensions, you would need an additional $50,000 annually.

Calculate Required Savings: Using a 5% annual return rate, you would need around $705,000 to generate $50,000 yearly for 25 years. For a perpetual income, you'd need $1 million ($50,000 ÷ 0.05).

Adjust for Duration: Use different factors for different retirement lengths (e.g., 12.5 for 20 years, 15.4 for 30 years). However, remember this is a simplified model and doesn't account for variables like taxes or inflation.

Consulting a Financial Professional

While this guide provides a foundation, consulting a financial professional for a more tailored assessment is advisable. They can align your retirement goals with suitable financial strategies and help navigate complex factors like market risks, tax implications, and inflation.

In conclusion, setting a retirement savings goal is more than just a number; it involves understanding your lifestyle aspirations, health care needs, and income sources, and balancing these with the realities of market risks and inflation. With this comprehensive approach, you're better equipped to plan for a comfortable and secure retirement.