As the landscape of retirement saving undergoes a significant transformation, the SECURE 2.0 Act, part of the sweeping federal spending bill passed in late 2022, stands at the forefront of this change. This legislation introduces critical adjustments to workplace retirement accounts, promising to shape the way Americans think about and prepare for their retirement years. Particularly, it casts a spotlight on Roth 401(k) accounts, offering intriguing opportunities for those in their peak earning years to secure tax-free income for their golden years. Let's dive deeper into these changes, their implications, and why now may be the perfect time to reassess your retirement saving strategy.

Major Changes Introduced by the SECURE 2.0 Act

Starting from 2026, individuals earning $145,000 or more in the previous year will encounter a pivotal shift. They will no longer be able to make pre-tax catch-up contributions to their traditional 401(k) or similar plans. Instead, they are provided with the option to make after-tax contributions to a Roth account, given its availability in their workplace plan. This modification is accompanied by an increase in the contribution limit for individuals aged 50 and above, who can now add an extra $7,500 over the standard annual limit of $23,000, with both figures subject to inflation adjustments.

This change may initially seem daunting to older workers in their peak earning years, who might miss the immediate tax deduction benefits of traditional 401(k) contributions. However, this nudge towards Roth contributions opens up a path to creating a tax-free income source for retirement, which can be tapped into as needed.

The Flexibility and Advantages of Roth 401(k) Contributions

Roth 401(k)s offer distinct benefits, particularly when it comes to tax management in retirement. While traditional retirement account distributions are taxed as ordinary income, qualified distributions from Roth accounts are tax-free, provided certain conditions are met. This feature becomes especially advantageous for individuals whose retirement income might push them into higher tax brackets, especially when considering the potential for increased tax rates in the future.

Moreover, Roth accounts play a crucial role in tax-efficient estate planning. The SECURE 2.0 Act aligns Roth 401(k)s with Roth IRAs by eliminating lifetime required minimum distributions (RMDs), allowing for tax-free growth and the option to pass on wealth to heirs without the tax burden associated with traditional retirement accounts.

Growing Popularity and Access to Roth 401(k) Plans

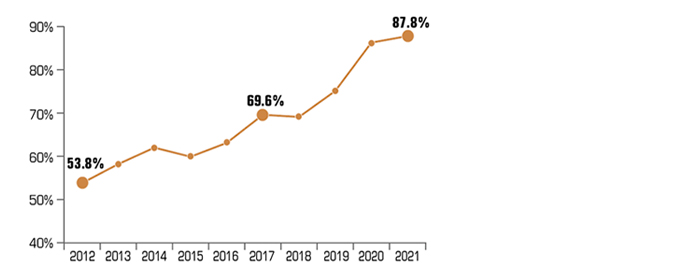

The prevalence of employers offering Roth 401(k) options has seen a significant uptick, jumping from 53.8% in 2012 to 87.8% in 2021. This trend underscores a growing recognition of the value these accounts bring to a diversified retirement saving strategy. Starting Roth contributions early is crucial, as it sets in motion the five-year clock needed for distributions to be qualified and tax- and penalty-free under certain conditions.

The prevalence of employers offering Roth 401(k) options has seen a significant uptick, jumping from 53.8% in 2012 to 87.8% in 2021. This trend underscores a growing recognition of the value these accounts bring to a diversified retirement saving strategy. Starting Roth contributions early is crucial, as it sets in motion the five-year clock needed for distributions to be qualified and tax- and penalty-free under certain conditions.

Enhancing Retirement Savings with New Opportunities

Looking ahead, the SECURE 2.0 Act introduces additional incentives for saving. From 2025, workers aged 60 to 63 can make "special" catch-up contributions significantly higher than current limits, further enhancing their ability to prepare for retirement. Employers also gain the flexibility to offer matching contributions on a pre-tax or after-tax basis, providing employees with more control over their tax liabilities and investment growth.

Final Thoughts: A Call to Action for Employers and Employees Alike

The changes brought about by the SECURE 2.0 Act highlight a shift towards recognizing the importance of Roth accounts in a comprehensive retirement planning strategy. For employees, particularly those nearing retirement, now is a critical time to reassess saving strategies to maximize the benefits of Roth contributions. Employers, on the other hand, are encouraged to adapt their retirement plans to include Roth options, ensuring their workforce has the tools necessary to achieve a financially secure retirement.

As we navigate these changes, the key to successful retirement planning lies in understanding the nuances of these new rules and taking proactive steps to leverage them. Whether you're an employee seeking to optimize your retirement savings or an employer aiming to enhance your retirement plan offerings, the SECURE 2.0 Act offers a pivotal opportunity to rethink and refine your approach to retirement planning.