Investing in bonds is a popular strategy for generating income, particularly among those seeking a blend of stability and returns in their investment portfolio. However, within the bond market, investors face a choice between individual bonds and bond funds, each offering distinct features, risks, and benefits. This detailed exploration aims to shed light on these differences, enhancing your understanding and aiding in making an informed decision suited to your financial goals.

The Core Differences

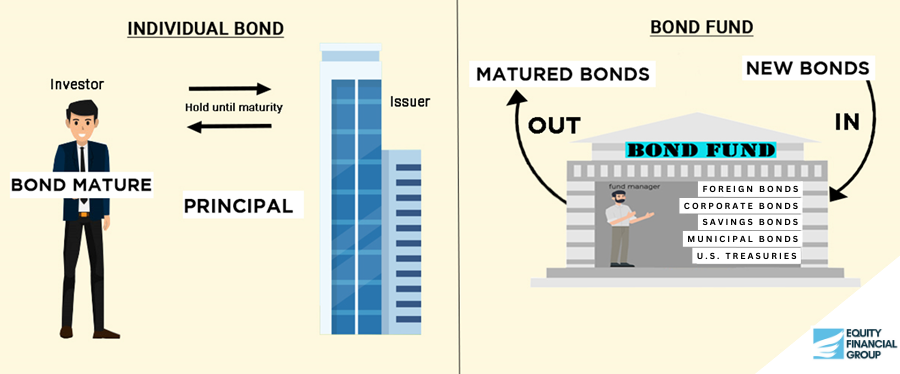

At the heart of the distinction between individual bonds and bond funds are the concepts of certainty, stability, diversification, and management. Individual bonds are known for their fixed income features, offering a coupon rate — essentially the annual interest rate paid on the bond's face value — and a specific maturity date when the principal amount is returned to the investor. This structure provides a predictable income stream and, if held to maturity, the return of the principal amount, barring default by the bond issuer. This predictability is a cornerstone of the appeal of individual bonds, offering a measure of stability and certainty in terms of cash flow and investment return, provided the investor is willing to commit for the duration until maturity.

In contrast, bond funds offer a path to diversification that is hard to replicate with individual bonds unless one has significant capital. A bond fund pools money from many investors to purchase a wide array of bonds, managed by professional fund managers. This diversification can mitigate risk, as the impact of any single bond's performance is diluted across the entire fund's holdings. However, bond funds introduce a different set of variables, including management fees and expenses, which can eat into returns, and the lack of a fixed maturity date, which introduces variability in the principal value upon exit from the investment.

Coupon, Maturity, and Yield Dynamics

The mechanics of yield calculation highlight further differences. For an individual bond purchased at face value, the yield is straightforwardly the coupon rate. However, if bought at a discount or premium in the secondary market, the yield adjusts to reflect the actual purchase price, offering an opportunity for enhanced returns if the market conditions are favorable. Bond funds, with their fluctuating share prices and monthly distributions that reflect the current portfolio's yield, present a more complex scenario for yield calculation. The 30-day SEC yield offers investors a standardized metric for comparison, reflecting the fund's net investment income on an annualized basis.

Performance Variances Over Time

Historically, the performance of individual bonds and bond funds has varied, influenced by market conditions, interest rates, and managerial strategies. While individual bonds offer a return guarantee if held to maturity (excluding defaults), bond funds' performance can fluctuate significantly, impacted by the fund manager's decisions and the broader bond market's dynamics. This variability underscores the importance of understanding one's risk tolerance and investment horizon when choosing between individual bonds and bond funds.

Interest Rate Sensitivity

Both individual bonds and bond funds are affected by interest rate changes, a crucial consideration for investors. Rising rates generally depress the market value of existing bonds and bond funds, as new issues come with higher yields. Conversely, falling rates can boost the value of existing bonds. However, the implications are more immediate for bond funds, whose value can fluctify significantly with interest rate movements, compared to individual bonds, which, if held to maturity, insulate investors from market value changes.

Diversification and Risk

While diversification through bond funds can mitigate risk, it's critical to acknowledge that it does not guarantee a profit or shield against loss. The investment's success depends on a variety of factors, including interest rate movements, the fund manager's skill, and the overall market environment. Prospective investors are advised to thoroughly examine the fund's prospectus, considering the investment objectives, risks, charges, and expenses before committing capital.

In Conclusion

Choosing between individual bonds and bond funds depends on one's investment goals, risk tolerance, and preference for active versus passive management. Individual bonds offer stability and certainty for those willing to lock in capital until maturity, while bond funds provide diversification and professional management at the cost of fees and potentially higher volatility. By understanding these nuances, investors can better navigate the bond market, aligning their choices with their long-term financial objectives.